Image Credit: katemangostar (Freepik)

Video marketing is often touted as on the most highly effective ways for B2B companies to reach new potential customers, capture leads, and grow their business. But, how do you really know if you are getting your money’s worth?

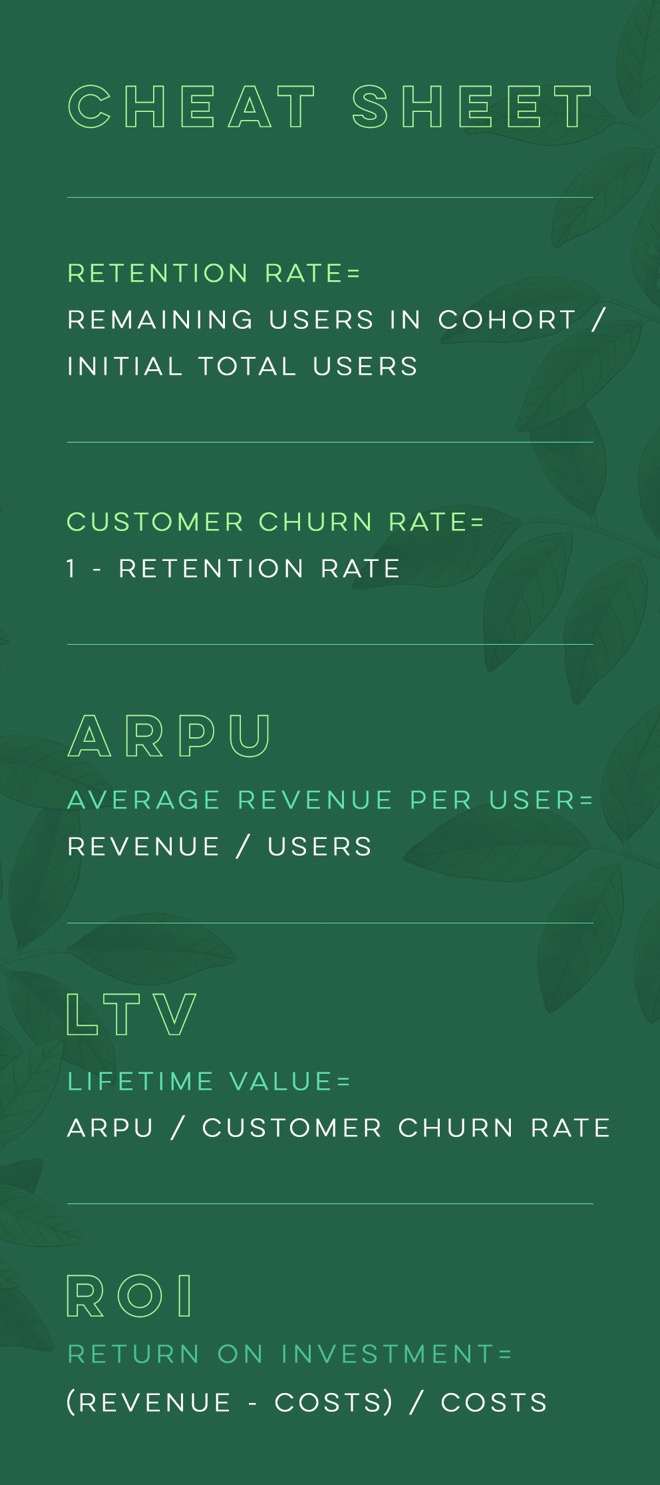

In this article, we walk you through how to track, calculate, and improve B2B video marketing return on investment (ROI). Scroll all the way down for a bonus cheat sheet guide to all the equations we’ll use at the bottom of the post!

Track the Right Data

Ideally, you will know the costs entailed in producing your video(s) and any marketing expenditures from the campaign. You also need to know the number of leads captured, whether or not any of those leads converted to paying customers, and the revenue generated from those customers. If your product is a subscription product, understanding churn metrics and the average customer lifetime will provide valuable insights that enable you to properly plan future expenditures on marketing endeavors.

Tracking the costs should be relatively straightforward. Typically, the production costs, hosting, and promotional costs specific to the video, or the campaign it is a part of, would be included.

Say you spent $500 on filming and editing the video, spend $25/month on video hosting, and ran a $50 ad campaign on Facebook, your total costs for that video would be $575. If you have more than one video, you probably wouldn’t assign the total cost of monthly hosting services to just one of your videos, so allocate your costs appropriately.

Then, after you have accumulated some signups from your campaign, track both conversion rate (the number of leads converting to paid users) and churn (the number of users from a cohort that cancel) for the campaign over time.

You might want to break it down by each channel, such as organic, paid, social, email, etc, which will bring greater granularity to your analysis. Whether you break it out by channel, or look at it overall, the calculations and methodology are the same.

Forecasting ROI

Forecasting ROI will require some educated guesses, or, you can work off of initial trial signups or leads generated by your campaign. If you are not working with initial signup data, you can build a forecast by estimating the amount of traffic your promotional efforts are likely to generate, the conversion rate of total traffic to leads or signups, and assigning a value to those leads to estimate revenue. If you are working with initial signup data, you can skip the traffic and conversion rate estimations, but you still need to assign a value to the leads and signups generated by your campaign.

There are many different ways to assign values to leads or signups. For instance, if you know total revenue generated by acquisition channel, you can divide that by the total number of customers you have acquired from each channel to determine average revenue per user (ARPU). You can also use monthly recurring revenue instead of total revenue to calculate ARPU, making it MRRPU.

As alternatives to ARPU, if you use lead-scoring to evaluate leads, you can assign a dollar amount to your lead-scoring metrics. Or, if you know the average customer lifetime value (LTV, more on that below) for your company, you can multiply the average LTV by the conversion rate from a prospect or trial user to a paying customer, either overall or by channel.

To forecast ROI based on leads or trial signups generated by a video campaign, assign a value to each signup to estimate revenue, according to the approach that makes the most sense for your business model, subtract costs from that revenue, and divide by the costs for that video.

For example, if your video cost $575, and generated 100 leads estimated to be worth $15 each, your forecast ROI would be ($1,500-$575)/$575 = 1.6. If you need to estimate the number of leads or signups that might be generated, use your total traffic estimate and multiply it by your estimated traffic conversion rate.

An ROI above zero is positive ROI, meaning you’ll make money with your campaign if your forecast is accurate. Negative ROI indicates a bad investment, so you’ll want to revise your campaign until you can safely anticipate a positive ROI.

Comparing your forecast to how your campaign actually turns out can provide some interesting insights, and can even allow you to make adjustments to your traffic flow sooner rather than later, making it a very worthwhile exercise.

Calculate Your Video ROI

The most common and simplest way to calculate ROI would be to take the dollar amount of revenue that was generated by your video campaign, and divide it by your total costs. If you acquired 50 paying customers worth $50 each, and the video cost, say, $575 from earlier, you would have an ROI of ($2,500-$575)/$575 = 3.34.

When calculated that way, this metric is a quick and easy way to compare the effectiveness of different video campaigns. If one video had a demonstrably higher ROI than others, for example, it would likely make sense to try that format again, or to invest more in ramping up the traffic to that video.

For a more sophisticated analysis, you will want to look at LTV, which requires the following data points to calculate: churn rate and average revenue per user, on a per-cohort basis if possible. You can track LTV and measure how it changes over time for each cohort you define. This is a really useful analysis that can inform how you determine marketing spend for future campaigns, and helps evaluate the longterm results of a campaign.

To calculate LTV for your video campaign cohort, divide average revenue per user by the customer churn rate. For example, if your ARPU is $20, and your churn rate is 2.5%, then LTV = $20/.025 = $800.

Then, to evaluate ROI based on that LTV, subtract the cost of acquisition from LTV, and then divide by the cost of acquisition. If we use the cost of $575 from earlier, ROI based on LTV would be ($800-$575)/$575 = 0.39.

That previous example assumes you only acquired one customer. If you acquire more than one, divide total costs by the number of customers acquired, and see how quickly that improves ROI. For instance, if you acquired five customers, the equation would be ($800-$115)/$115 = 5.9.

This type of evaluation is really important to understand whether the customers acquired by a specific campaign are truly profitable or not for a company with a recurring revenue business model. If LTV is not greater than the cost of acquisition, you will see a negative ROI in the long run.

For additional reading on LTV, including ways to adjust for your gross margins, please refer to this excellent guide to the ins and outs of calculating LTV by For Entrepreneurs.

Keep track of these metrics over time, typically on a monthly basis, and update your analysis. This data is critical for calculating LTV and your video marketing ROI, and will ultimately help you run better, more profitable video marketing campaigns.

As promised, here is a cheat sheet with all the equations we used in the above post: