If you have an idea for a great product, but haven’t got a prototype, how do you convince investors to fund your venture?

Here are all the practical tips you’ll need for creating a video that has the wow factor to get investors keen to be part of the journey.

Be Quick!

Whether online, on crowd-funding platforms like Kickstarter and Indiegogo, or in-person, you’ll quickly realize that investors are cash-rich and time-poor. They want to understand your idea as fast as possible, why it’s better than everything else currently available, and how you’re going to make it happen.

It doesn’t matter if you don’t have anything material, like a product demo, to show potential investors. The important point is ensuring they understand your vision. To keep the investors engaged, and to get your point across quickly, we recommend using video.

After all, data from Kickstarter shows that projects featuring video are 85% more likely to get funded than projects without video. That’s a big boost!

Here is a summary of what you’ll need to cover:

- Who’s on your team?

- What’s the idea?

- What problem does it solve?

- Who will benefit?

- What is your addressable market?

- Is the timing right for your product?

- Are there any competitors? How is your idea differentiated?

Super Earlier Stage Video Marketing

It’s possible that you might be too early stage to attract serious investors. Still, it’s never too early to capture leads for when you’re gearing up to launch your campaign.

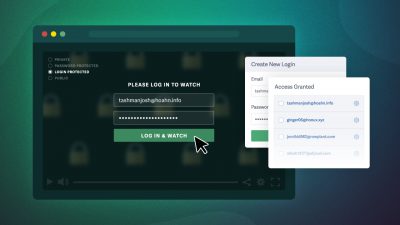

Using an email-gated video, you can send email addresses to the marketing platform of your choice. From there, send a drip campaign explaining the timeframe for when you expect to have more details about your project, and when you’ll be able to accept investments. Keep leads engaged with periodic video updates, sharing the latest on any new developments.

Another alternative would be to use a post-play screen, displayed once your video concludes, to direct interested viewers to a landing page of your choice. It could be a signup form to be an early beta tester, or to join a wait-list, or downloads with more details about your project.

Get the Conclusion Right

The conclusion of your video is key. The right ending depends on the audience you are addressing with your pitch.

Online community of investors: Think of the conclusion as your final, most important call to action. Focus on a truly individual approach. People are more likely to provide assistance if they feel a personal connection to the project, and that it’s not just about the money. Don’t forget to emphasize what the investors will gain by donating to your project. Above all, remember to thank them!

Professional investors: The conclusion of your video should be the start of the conversation about the market opportunity for your concept. Ideally, investors will be intrigued by the main segments of your video, and looking to get into details about your strategy and growth prospects.

Don’t Share Everything

Ideally, investors will be eager to learn more after watching your concept video. We know you’ll be excited to share your ideas and enthusiasm during the video, but be strict with yourself when planning the content.

There simply won’t be enough time in your video to share everything you want. After all, you’ve probably been living and breathing this new venture for months. The video would be hours long if you told the whole story!

When you’re pitching to professional investors, more detailed content, such as your own experiences that lead to the idea or the results of a focus group, are best discussed after you have shown the video. By all means, hint during the video that you are keen to share this material, but save it for the subsequent conversation. In this case, you have the advantage of being in the room, and certain aspects of your story will come across as more authentic in person.

If you’re creating the video for an online investment community, you can share a little more. In fact, some background on how you got the idea would be interesting for viewers. By giving it a personal touch, you’ll increase the likelihood they’ll feel comfortable investing.

Particularly if you are posting the video on a public investment platform, it is important that you protect your concept. Do not share details that would enable users to replicate your idea. If you’re asked for more information, the interested party should sign a nondisclosure agreement.

Check, Check and Check Again

Before you share the video online or commence a meeting with investors, you need to review it thoroughly. Ask a trusted colleague or family member to watch it too. Everything must be accurate.

One of the aims of your video is to establish trust with your investors. They must be able to trust every claim you make in the video. Investors will not be impressed if they discover inaccuracies in the video – it could jeopardize your chances of winning funding.

Have you made a video pitch to investors? Share it with us on Twitter or Facebook!